Analytics

Makonis, as a Business Intelligence and Analytics company, has deep experience in executing BI, Analytics, Big Data and Data Science projects covering data integration, data governance, dashboards & reports, ad-hoc analysis, migration, big data analytics, data science, real-time analytics, mobile BI, cloud BI and production support. Our Data analytics consulting services unlocks various hidden opportunities and insights that cause a drastic effect on your business operations. We turn technology into business outcomes by delivering information management, business intelligence and analytic solutions under one roof. We harness big data analytics to drive better business outcomes and use next gen-analytics to power your data-driven organization.

CUSTOMER ANALYTICS

Customer analytics, also called customer data analytics, is the systematic examination of a company's customer information and customer behavior to identify, attract and retain the most profitable customers. The goal of customer analytics is to create a single, accurate view of a customer to make decisions about how best to acquire and retain customers, identify high-value customers and proactively interact with them. The better the understanding of a customer's buying habits and lifestyle preferences, the more accurate predictive behaviors become and the better the customer journey becomes. Without large amounts of accurate data, any insight derived from analysis could be wildly inaccurate.

Things we can cover:

- Pricing Model

- Churn Analysis

- Data Segmentation

- Loyalty Model

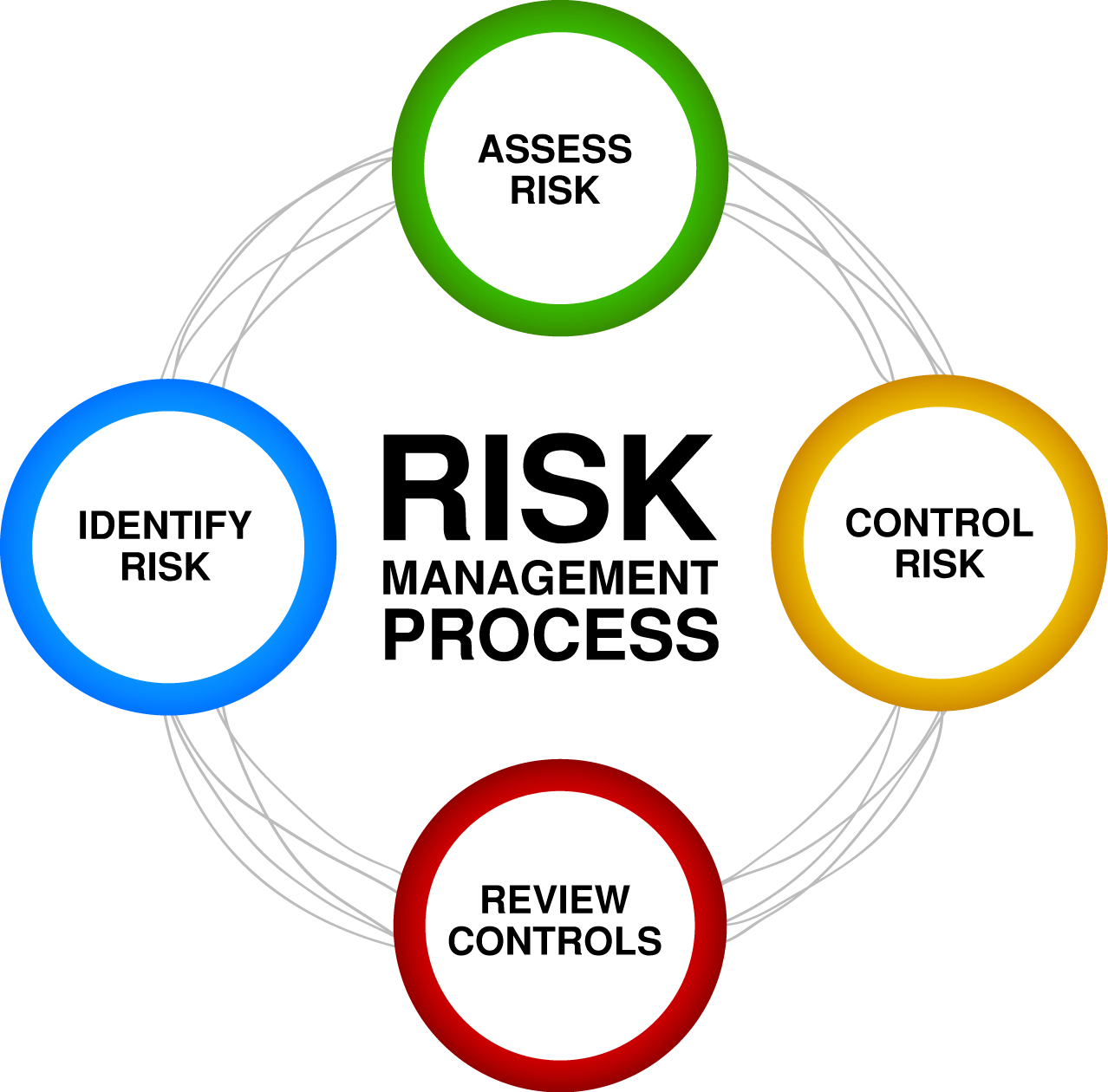

RISK ANALYTICS

Risk analytics (or risk analysis) is the study of the underlying uncertainty of a given course of action. It often works in tandem with forecasting professionals to minimize future negative unforeseen effects. The uncertainty of forecasted future cash flows streams, variance of portfolio/stock returns, statistical analysis to determine the probability of a project's success or failure, and possible future economic states, these all fall under risk analytics.

You can mitigate these risks by clearly defining, understanding, and managing tolerance for and exposure to risk. Advanced analytics capabilities enable clearer visibility into the challenges associated with managing the many types of risk in such key areas as operations, regulatory compliance, supply chain, finance, ecommerce, and credit. By using analytics to measure, quantify, and predict risk, leaders can rely less on intuition and create a consistent methodology steeped in data-driven insights.

Risk analytics solutions enable you to:

- Improve decision making by providing risk analysis, insight and transparency.

- Reduce the cost of regulatory compliance.

- Dynamically evolve with a risk architecture that can efficiently adapt as risk management practices, client demands and regulations change.

FINANCE

We all know the emerging effect of digitalization in the financial economy. Not just it is creating a requirement for the storage of huge data but also has led to a situation where the huge data needs to managed efficiently and the best data out of it should be extracted so that it can be helpful on the further stages. Typically, financial analysis is used to analyze whether an entity is stable, solvent, liquid or profitable enough to warrant a monetary investment. When looking at a specific company, a financial analyst conducts analysis by focusing on the income statement, balance sheet, and cash flow statement.

Helpful in:

- Cash flow analysis

- ROI Analysis

- P & L Analysis

- Revenue Analysis

HR ANALYTICS

Human resource analytics (HR analytics) is an area in the field of analytics that refers to applying analytic processes to the human resource department of an organization in the hope of improving employee performance and therefore getting a better return on investment. HR analytics does not just deal with gathering data on employee efficiency. Instead, it aims to provide insight into each process by gathering data and then using it to make relevant decisions about how to improve these processes.